IFRS Sustainability Disclosure Standards Issued, Paving the Way for Integration of Financial and Non-Financial Performance | Latest Information | ASUS ESG website, ASUS ESG goal

Article

2024/01/22

IFRS Sustainability Disclosure Standards Issued, Paving the Way for Integration of Financial and Non-Financial Performance

-

Copied to clipboard

Why are the IFRS Sustainability Disclosure Standards matter?

According to Bloomberg Intelligence's "ESG Outlook Report"1 released in 2021, the capital markets are providing financial support for energy transition. How to correctly channel funds from the market into economic activities with sustainable development potential will also be a major challenge for future capital markets. The report indicates that ESG assets are expected to exceed $50 trillion by 2025, accounting for one-third of global assets under management.

However, over the past two decades, with the continuous growth of ESG-related investments, the relatively loose regulatory framework behind it has allowed companies the freedom to choose the content and structure of sustainability information disclosure, making it difficult for investors to use such information. For investors, despite the abundance of sustainability information in the capital markets, what is truly lacking is "meaningful" high-quality sustainability information. Accompanied by the emergence of the "Greenwashing" issue, major economies worldwide have all proposed corresponding policies in the past two years, hoping that the framework for sustainability reporting can be "standardized" and "simplified" in the future.

Integration and evolution in sustainability disclosure frameworks

At the COP26 (Conference of the Parties of the UNFCCC 26) conference, the International Financial Reporting Standards (IFRS) Foundation announced the establishment of the International Sustainability Standards Board (ISSB). The ISSB aims to create a set of high-quality global standards for sustainability disclosure, known as the IFRS Sustainability Disclosure Standards, to meet the needs of investors and capital markets.

The IFRS Sustainability Disclosure Standards include General Requirements (S1) and Climate-related Disclosures (S2):

- IFRS Sustainability Disclosure Standard S1:

- IFRS Sustainability Disclosure Standard S2:

IFRS has two significant advantages in establishing new international sustainability reporting standards:

- Prestige

IFRS has extensive experience and profound influence in establishing globally unified international financial reporting standards.

- Comprehensive and Inclusivity

Unlike the GRI (Global Reporting Initiative) standards, which aim to disclose a wide range of sustainability issues to diverse stakeholders, the IFRS Sustainability Disclosure Standards are based on an international integrated reporting framework from the outset and incorporate industry-specific provisions from SASB (Sustainability Accounting Standards Board). Additionally, they will continue to incorporate guidelines on environmental issues such as climate change from CDSB (Climate Disclosure Standards Board). Thus, the IFRS Sustainability Disclosure Standards establish a comprehensive framework for sustainability financial reporting aimed at investors. ISSB took in charge of the Task Force on Climate-related Financial Disclosures (TCFD) reporting framework in 2024.

The main difference between IFRS S1/S2 and GRI

The emergence of the IFRS Sustainability Disclosure Standards undoubtedly represents both a risk and an opportunity, driven by the demands from capital markets, for a framework that has existed for over twenty years like GRI. The greatest differences between the two are as follows:

- Audience for Sustainability Reporting Framework

Both the IFRS Foundation and the GRI standards have signed a cooperation agreement, and both adopt two main pillars of international sustainability reporting guidelines. The first is investor-centric, and the second is to meet the diverse needs of stakeholders. Companies adopting the IFRS Sustainability Disclosure Standards for disclosing sustainability information can meet investors' expectations of meaningful sustainability information, with disclosures focusing on sustainability issues of interest to investors and capital markets.

- Assessment of Materiality Issues

In addition, the other major difference between the IFRS Sustainability Disclosure Standards and the GRI standards lies in their approach to identifying materiality issues. The IFRS Sustainability Disclosure Standards assess the materiality of issues identified by companies in terms of their "financial materiality," whereas the GRI standards emphasize the impact of material issues on the external environment. Through the difference in their definitions of materiality, it reflects the different core value of information disclosure between the two as well. The IFRS Sustainability Disclosure Standards view sustainability issues as part of enterprise risk management, where companies should assess the financial impacts or opportunities of sustainability issues and their implications for financial statements. On the other hand, the GRI standards focus on an organization's impact on external economic, environmental, and social factors, while also requiring disclosure of management policies aimed at mitigating negative impacts.

The core value of the two frameworks represent the two perspectives proposed by the EU's concept of Double Materiality for assessing the materiality of issues: the "impact of the external environment on enterprise value" and the "impact of enterprises on society and the environment." Therefore, despite the differences in structure between the two standards, they have a complementary and mutually reinforcing relationship. Both standards also signed a Memorandum of Understanding (MoU) at the inception of the ISSB (International Sustainability Standards Board). The GRI standards ensure transparency of enterprise sustainability disclosures to their stakeholders, while the IFRS Sustainability Disclosure Standards focus on supporting efficient and flexible capital markets.

ASUS takes the lead by aligning with IFRS in 2022 Sustainability Report

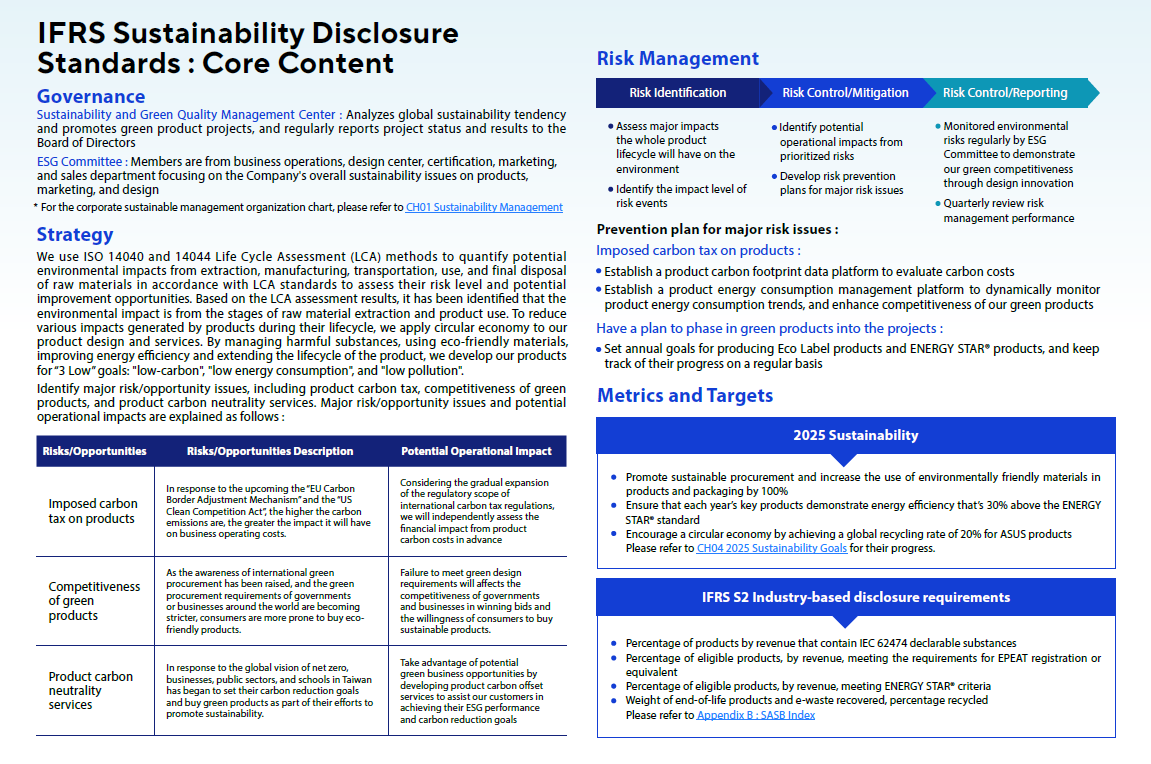

ASUS took the lead by incorporating the draft of the IFRS Sustainability Disclosure Standards into its 2022 sustainability report. For the first time, in the four major sustainability pillars—Circular Economy, Climate Action, Responsible Manufacturing, and Value Creation—ASUS disclosed the risks and opportunities arising from material issues in Governance, Strategy, Risk Management, and Metrics and Targets.

Identifying Sustainable Risk and Opportunity:Circular Economy

The operational impacts identified in 2023 are in the preliminary assessment stage. In the future, ASUS will plan to further strengthen risk and opportunity scenario simulations and assess the impact on financial figures to enhance the overall risk management and response mechanisms.

IFRS S1/S2: Emphasizing Risk Management and Financial Impact, Not just for ESG Performance

The establishment of global accounting reporting standards by the International Accounting Standards set a solid foundation for the subsequent establishment of international sustainability reporting frameworks. While the emergence of the IFRS Sustainability Disclosure Standards can be seen as standardizing and simplifying the diverse disclosure regulations and standards across different countries and regions, companies still need to synchronize their emphasized risk management policies with their core governance mechanisms when considering the applicability of the IFRS Sustainability Disclosure Standards. The existence of these standards aims to optimize internal enterprise management rather than surpassing enterprises to become a means of recognizing sustainability performance.

The IFRS Sustainability Disclosure Standards provide internationally consistent disclosure standards, increasing comparability of sustainability information and preventing greenwashing. IFRS S1/S2 officially came into effect on January 1, 2024, and each country's regulatory authorities may decide whether or when to adopt them. Taiwan's Financial Supervisory Commission announced in July 2023 that it aligned with and adapted to the domestic industry environment by introducing the Taiwan version of the IFRS Sustainability Disclosure Standards. In the first phase, it will be applied by 83 listed companies with a capital of over 10 billion NT dollars to prepare sustainability information in 2026 and disclose it in their annual reports in 2027.

Appendix:

| Terms | Explanation |

|---|---|

| The GRI standards | The Global Reporting Initiative (GRI) develops the Sustainability Reporting Standards. |

| SASB indicators | The indicators of the Sustainability Accounting Standards Board (SASB) are developed based on industry characteristics and investor demands, thus providing more specific and practical sustainability information to assist investors in making better investment decisions. |

| The Task Force on Climate-related Financial Disclosures (TCFD) reporting framework | The Task Force on Climate-related Financial Disclosures (TCFD) is a global initiative established by the Financial Stability Board (FSB) and launched at the end of 2015. TCFD aims to encourage companies to disclose climate-related risks and opportunities in their financial reports, assisting investors, creditors, and stakeholders in conducting more comprehensive assessments of climate risks. |

| CDSB stands for Climate Disclosure Standards Board. | CDSB has developed the Climate Change Reporting Framework, aiming to assist companies in integrating climate-related information into their financial reports. |

1 Bloomberg: ESG Assets Rising to $50 Trillion Will Reshape $140.5 Trillion of Global AUM by 2025, Finds Bloomberg Intelligence

2 金融監督管理委員會: 我國規劃接軌國際財務報導準則(IFRS)永續揭露準則,提升永續資訊品質及透明度

Reference:

【第九屆發表會系列報導二】適時適度量化與整合對透明揭露的重要性 – CSRone 永續智庫

商道融绿 SynTao Green Finance:解讀ISSB標準,展望ESG信披新格局

Related Article